![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

88 Cards in this Set

- Front

- Back

|

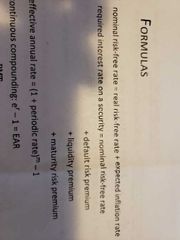

Fisher Effect |

Nominal Interest Rate = Real interest rate + expected inflation rate |

|

|

Required interest rate on a security |

|

|

|

Effective annual rate |

(1+ periodic rate)^m -1 |

|

|

Continuous compounding |

e^r -1 = EAR |

|

|

Bank discount yield or Discount Basis Yield |

D/F x 360/t (Fv - price)/Fv x 360/t |

|

|

HPY |

HPY = (P1-P0+D1)/P0 = (P1+D1/P0) -1 |

|

|

EAY |

Effective Annual Yield = (1+HPY)^(365/t) -1 |

|

|

MMY |

Money Market Yield = HPY(360/t) MMY = (Fv - price)/price x (360/t) |

|

|

Geometric Mean Return |

1+Rg = n•sqrt((1+R1)•(1+R2)•..•(1+Rn)) |

|

|

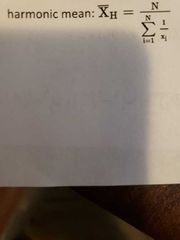

Harmonic Mean |

|

|

|

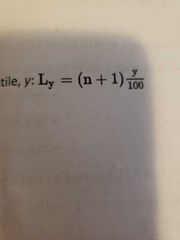

Position of obs at a given percentile (y) |

|

|

|

Population & Sample Variance |

|

|

|

Coefficient of Variation |

Standard deviation/mean |

|

|

Sharpe Ratio |

(Rp-Rf)/(st.dev.p) |

|

|

Joint probability |

P(AB) = P(A/B) x P(B) |

|

|

Addition Rule |

P(A or B) = P(A) + P(B) - P(AB) |

|

|

Multiplication Rule |

P(A and B) = P(A) x P(B) |

|

|

Covariance & Correlation |

|

|

|

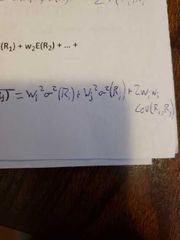

Portfolio Variance |

|

|

|

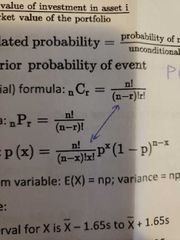

Bayes Formula |

P(B/A) = P(B) x P(A/B) / P(A) |

|

|

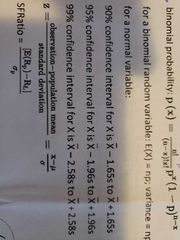

Binomial Probability |

|

|

|

Standard Normal distribution reliability factors |

|

|

|

Z (normal dist) |

Z= (observation - population mean)/standard deviation |

|

|

Roys SF Ratio |

(E(Rp) - RL)/st.dev. RL = Threshhold level return |

|

|

Continuosly compunded rate of return |

Ln(1+HPR) |

|

|

Standard error |

(Standard dev or sample dev)/sqrt(n) |

|

|

Confidence interval |

|

|

|

Tests for population mean |

|

|

|

Paired comparisons Test |

|

|

|

Own price elasticity |

(% change in quantity demanded) / (% change in own price) |

|

|

Income elasticity |

(% change in quantity demanded)/(% change in income) |

|

|

Cross price elasticity |

(% change in quantity demanded)/(% change in price of related good) |

|

|

GDP deflator |

(Nominal GDP in year t)/(value of year t output at base year prices)×100 |

|

|

GDP |

GDP=C+I+G+(X-M) |

|

|

Consumer Price Index |

(Cost of basket at current prices)/( cost of basket at base period prices) × 100 |

|

|

Money Multiplier |

1/Reserve Requirement |

|

|

Equation of Exchange |

Money Supply x Velocity = Price x Real Output MV=PY |

|

|

Aggregate Demand |

(X-M) = (S-I) + (T-G) |

|

|

Fiscal Multiplier |

1/(1-MPC(1-t)) MPC = Marginal Propensity to Consume |

|

|

Real Exchange Rate |

RER= Nominal Exchange Rate x (CPIb/CPIp) CPIb = CPI base currency CPIp = CPI price currency |

|

|

Receivables Turnover & Days of Sales Outstanding |

RT = annual sales/ average receivables DoSA = 365/RT |

|

|

Inventory Turnover & Days of Inventory on Hand |

IT = COGS/ average inventory DoIOH= 365/IT |

|

|

Payables Turnover & Number of days of Payables |

PT = Purchases/ average payablesNoDoP = 365/PT |

|

|

Quick Ratio |

(Cash + marketable securities + receivables )/ (current liabilities) |

|

|

Cash Conversion Cycle & Operating Cycle |

CCC = Days of Sales outstanding + Days of Inventory on hand - Number of Days of Payables OC = Days of Sales outstanding + Days of Inventory on hand |

|

|

Interest Coverage |

EBIT/Interest Payments |

|

|

Fixed charge coverage |

(EBIT + Lease Payments) / (Interest Payments + Lease Payments) |

|

|

Free Cash Flow to the Firm |

FCFF = net income + noncash charges + (cash interest paid (1-t)) - fixed capital investment - working capital investment Net income + noncash charges - working capital investment = CFO |

|

|

Free Cash Flow to Equity |

FCFE = cash flow from operations - fixed capital investment + net borrowing |

|

|

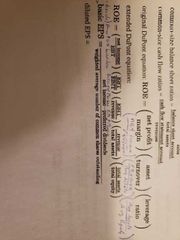

Original & Extended Dupont |

|

|

|

Basic EPS |

Basic EPS = (net income - preferred dividends) / (wheighted avg number of common shares outstanding) |

|

|

Purchases |

Ending Inventory = Beginning Inventory + Purchases - COGS |

|

|

LIFO to FIFO |

Inventory: LIFO Inv + LIFO Reserve COGS: LIFO COGS - delta(LIFO RESERVE) |

|

|

DDB Depreciation |

(2/useful life)(cost - Ac. Depreciation) |

|

|

Income Tax Expense |

ITE = Taxes Payable + delta(DTL) - delta(DTA) Taxes Payable = Taxable Income x Statutory Rate |

|

|

Effective Tax Rate |

ETR = ITE/PTI ITE = Income Tax Expense PTI = Pre Income Tax |

|

|

Profitability Index |

1+(PV of future Casf Flows/CF0) |

|

|

Cost of Preferred stock |

Kps = Dps/P |

|

|

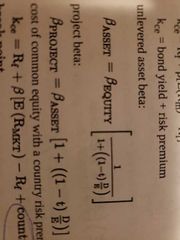

Cost of Common Equity |

Kce = D1/P0 + g

Kce = Rf + Beta(Rm - Rf + country risk premium)

Kce = bond yield + risk premium |

|

|

Unlevered Asset Beta & Project Beta |

|

|

|

Degree of Operating Leverage |

Q(P-V) / (Q(P-V)-F) % change in EBIT / % change in sales |

|

|

Degree of Financial Leverage |

EBIT / (EBIT - I) (Q(P-V)- F) / (Q(P-V)- F - I) % change in EPS / % change in EBIT |

|

|

Degree of Total Leverage |

DOL x DFL % change in EPS / % change in sales |

|

|

Bond Equivalent Yield |

BEY = (Fv - price)/price x (365/t)

BEY = HPY x (365/t)

BEY = 2(Effective semi-annual yield) |

|

|

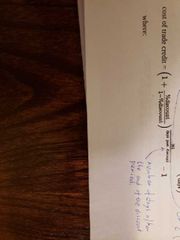

Cost of Trade Credit |

|

|

|

CML |

Rp = Rf+ (Rm - Rf)(st.dev.p/st.dev.m) |

|

|

Beta |

Beta = COVi,m / VARm = CORRi,m(st.dev.i/st.dev.m) Beta measures sistematic risk. |

|

|

SML |

Same as CAPM Ri = Rf + Beta(Rm - Rf) Plots return (y axis) vs Beta (x axis) |

|

|

Margin Call Price |

MCP = Po ((1-Initial Margin) / 1- Maintenance Margin)) Initial Margin is Equity % |

|

|

Gordon constant growth model |

Po = D1/(Ke - g) Ke = req. Rate of return g = expected growth rate |

|

|

Earnings multiplier |

EM = Po/E1= expected dividend payout ratio / (k - g) |

|

|

Enterprise Value |

Market value of common & preffered stock + market value of debt - cash & short term investments

Or EBITA × EV Multiplier Market value of common stock = market cap |

|

|

Bond Flat Price |

Full price - accrued interest |

|

|

Forward & Spot Rates |

(1× S2)^2 = (1+S1)(1+1Y1Y) |

|

|

Option Adjusted Spread |

OAS = Z-Spread - Option Value |

|

|

Modified Duration |

Macaulay duration / (1+YTM) |

|

|

Aprox % change in bond price |

-ModDur x deltaYTM |

|

|

Aprox Modified Duration |

(V_-V+)/(2Vo•deltaYTM) |

|

|

Approximate Convexity |

|

|

|

Risk- free asset |

Risky asset + derivative |

|

|

Value of Forward at time t |

|

|

|

Option Value |

Intrinsic Value + time value |

|

|

Put - Call Parity |

S = C - P + X(1+Rf)^T |

|

|

Risk Neutral probability of an Up Move |

(1 + Rf - D)/(U-D) D = 1/U |

|

|

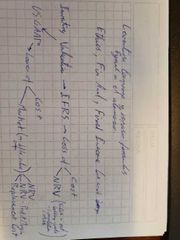

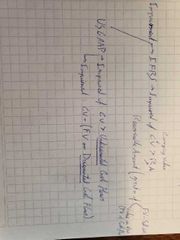

Inventory Valuation IFRS & US GAAP |

|

|

|

Impairment IFRS & USGAAP |

|

|

|

Interest Rate Parity |

Forward/Spot = (1+ Interest Rate price currency)/(1+ Interest Rate base currency) |

|

|

Approx price change given Duration & Convexity |

-Duration x delta(yield) + 1/2 x Convexity x delta(yield)^2 |