![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

32 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

(Chapter17) Cost (Required to obtain property) |

Actual estimated amount required to create produce or obtain a property |

|

|

|

Price (Amount actually paid) |

The amount that's actually paid in real estate transaction |

|

|

|

Value (Opinion of work of a property) |

Value is an opinion of work of a property at a given time in accordance with a specific definition of value |

|

|

|

Liquidation value (Amount remaining after assets are sold) |

The amount that remains after all assets of business have been sold. hurried, but not forced, sale and all liabilities have been paid. |

|

|

|

Market value (Value estimated by appraises) |

The value to a typical buyer/Sellers, This is the most common type of value that is estimated by appraisers. |

|

|

|

Principle of highest and best use (Best use of property,most profitable use) |

The best use for the property, known as its highest, best, most profitable use, that which will most likely produce greatest net return to land over a given period of time. |

For future use of land and improvements |

|

|

Principle Of substitution (No one would pay more than whats necessary) |

Recognizes no one would pay more for a property then the amount necessary to acquire an acceptable substitute. This is the basis for all mathematical methods that are used by appraisers to estimate value. |

|

|

|

Adjust the Comparable Sales Prices (Adjustments only to comparable property) |

Adjustments are always made to the comparable property, but never to the subject property. |

|

|

|

Comparable Property vs. Subject Property (Comparable property is Superior to subject "inferior") |

Comparable property is Superior To the Subject property comparable sales prices adjusted downward by value of the superior (+) features if the comparable property is inferior(-) to the subject property, the comparable sales prices adjusted upward by the value of the inferior features. |

Superior means subtract(-) Inferior means increase (+)

|

|

|

Reproduction Costs (Estimated costs to construct current price) |

Estimated costs to construct at current prices an exact duplicate or replica of the building but is being appraised using the same materials, design, layout as subject property. Reproduction cost is preferred in appraisals of historic properties. |

|

|

|

Cost depreciation Used to estimate newer property value) |

Best used to estimate value of newer properties, property proposed for renovations, and insurance proposes, and properties infrequently exchanged are sold in the real estate market. |

Example library, courthouse. |

|

|

Functional Obsolescence (Caused by deficiency or over improvements) |

Aka*Economic Obsolescence*, Can be caused by either a deficiency or and over- improvements or (Super Adequacy). |

|

|

|

Over improvement (Improvement of property not well invested) |

And investments made to a property that does not make the best use of property or is excessive and comparison with the improvement of similar properties. Will not sell in the market for the amount invested. |

Example: a swimming pool that cause $50,000 to construct , but the market is only willing to pay $10,000 for the pool |

|

|

External obsolescence (Loss in value by factors beyond boundaries) |

A loss in value caused by factors beyond the boundaries of the subject property. |

|

|

|

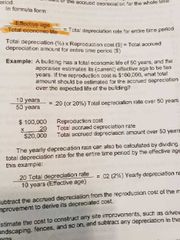

Economic Age-Life Method (Appraisers estimates total economic life of building) |

Appraisers estimates total economic life of building which is number of years it will contribute value above the land that is 100% of its useful life. Appraiser than estimates the percentage of total life lost or used up by depreciation. |

|

|

|

Effective (life depreciated) |

Total life lost or used up by depreciation. |

Page 309 |

|

|

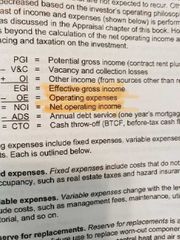

Reserves for Replacement (R) (Not included in operating expenses) |

Operating expenses do not include mortgage payments, tax depreciation, capital improvements, personal expenses, or related to the operation of the property & income taxes. |

|

|

|

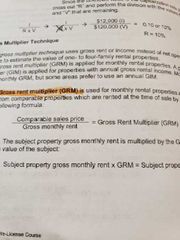

Gross Rent Multiplier (GRM) (Formula Comparing monthly rental properties) |

Use monthly rental properties and is derived from comparable properties which are rented at time of sale by using following formula |

Page 312 |

|

|

Real estate investment analysis (Disadvantages include illiquidity of property) |

Disadvantages of investing in real estate includes the a illiquidity of property (it cannot be bought or sold as quickly as other Assets) |

|

|

|

Capital Gain/Loss (Increase in a value of asset, giving it higher value than cost) |

Capital Gain is an increase in the value of an asset, such as personal or investment property, that gives it a higher value than the cost of purchasing a Asset. |

|

|

|

Static risk (A fire can be offset with insurance) |

A risk (parrel) can be offset with insurance, such as the fire, flood, robbery and so on. |

Parrel |

|

|

Evaluating Investment Properties (E G I, O E, N O I) |

Effective gross income- EGI Operating expenses. OE Net operating income. NOI |

Page 329 |

|

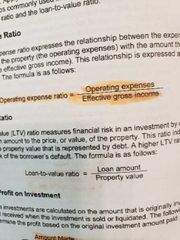

|

Operating expense ratio |

|

Page 330 |

|

|

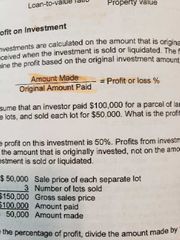

Amount paid divided by original amount paid |

|

Page 330 |

|

|

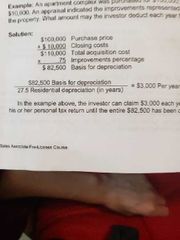

Depreciation (May depreciate investment residential 27.5 years, nonresidential 39yrs) |

Tax laws allows owners of residential low income and investment properties INCLUDING MOBILE HOMES, may depreciate a portion of their investment on over 27.5 years on a straight line basis. The owners of nonresidential investment properties may depreciate a portion of their investment over 39 years also on a straight line basis. |

Page 332 To calculate this total cost of acquisition including total cost of property plus closing costs is allocated on a percentage basis to the land improvements the basis for deficient that portion of the total cost including causing cause which applies to the improvements lands cannot be depreciated. |

|

|

Tax deferred exchanges (Allows capital gain from sell of properties by exchange of properties) |

Allows any capital gain realized from sell of investment properties to be transferred into another property by exchanging properties. |

|

|

|

Like - kind exchange (Exchanging of investment real estate) |

An investment real estate that is exchanged for other investment realestate |

Problem with this type of transaction most properties do not have same value therefore in order to conclude the exchange investors often include cash, other forms of unlike property, to at equalize the transaction. |

|

|

Boot (Deferred capital gain postponed until property sold) |

Unlike property received in a tax -deferred exchange and is taxable to the recipient. To the Extent that the equities are equal , capital gain is deferred or postponed until property is sold. |

Cheek and boot |

|

|

Going concern value (Value of all Assets combined, licenses, franchises, intangible assets) |

Value of a business is not just the value of any real estate owned, but rather, a composite of the values of the Real estate , personal property, and intangible assets. Such as licenses, franchises, noncompetition contracts, and so on. |

|

|

|

Reasons for a business appraisal To establish a sale. Purchase price, a loan etc) |

Buisness owners, or potential purchasers ,may request an appraisal in order to establish a sales or purchase price, obtain a loan, or for insurance purposes, other reasons include condemnation, by-sell agreements, proper settlements, estate Settlement Or to be used in connection with employee stock option plans. |

Insurance purposes condemnation estate settlements |

|

|

Tangible assets (Physical) |

Assets that have physical existence such as buildings, furniture, office equipment, and so on. |

|

|

|

Intangible assets (Not physical, stock shares, trademarks etc) |

No physical existence, but have monetary value, intangible assets include stock shares, trademarks, copy rights etc. |

Trademarks |