![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

19 Cards in this Set

- Front

- Back

|

Compare the effectiveness of supply side and fiscal policies to correct deficits on a country's current account of the Balance of Payments |

Define current account deficit To reduce it either decrease imports or increase exports

Supply side - improve the productivity of the economy. If more productive, cost of production will fall, making goods more competitve and increaseing exports.

(1) Increasing education and training

(2) Decreasing trade union power

(3) Increasing labour mobility - greater provision of rented market

FISCAL POLICY can be used to decrease consumer spending and therefore reduce demand for imports as there is usually more imports when incomes are higher

(4) Income tax - COunter: depends on MPM but high MPM so would be effective

(5) Reduced gov spending - less money spent on imports H/E: conflict with other issues i.e. unemployment |

|

|

Define current account balance of payments |

Measure exports and imports

- Trade in goods - Trade in services - Investment incomes (dividends) - Net transfers (international aid) |

|

|

Define globilisation |

Hard to precisely define but involves the increased intergration and interdependence of economies throughout the world |

|

|

Discuss the impact of globilisation on the UK economy |

(1) define

(2) Seen a rise in international trade which has allowed for law of comparitive advantage (define) and for fall in tarriffs and transport costs causing cheaper imports, increasing Uk consumer surplus. Also led to rise in consumer choice COUNTER: has led to rise of more homogenous products as transnational companies dominate market share, forcing out smaller companies because of economies of scale

(2) Enabled firms to benefit from economies of scale (insert graph). Eg. car construction in different countries - leads to lower prices for UK customers COUNTER: led to interdependence within countries 0 greater chance of recession

(3) Increased competition - domestic monopolies now face competition from other countries - reduces x=innefficiency, keeping prices lower for consumers COUNTER: led to unemployment and many UK firms leaving industry h/e globilisation may have led to decline in some areas, growth in others i,e, financial services

(4) Increased mobility of capital and labour. I,E, Europe, Bulgaria - increases flexibility of labour market and reduced labour shortages. H/E placed pressure on schools and public services

|

|

|

Both the UK and US balance of payments accounts are recording large deficits on their trade in goods balance. Do such deficits matter? |

(1) define trade deficit in goods

(1) indicates a lack of UK competitiveness. Consumers preferring to buy imports than domestic production

(2) indicates a surplus on the financial account - this could involve short term capital flows from abroad which might dry up. I.e. US financed current account deficit by attracting capital inflows from China - makes US economy vulnerable to US withdrawing dollar holdings COUNTER: UK is seeing lots of long term capital inflows - i.e. infrastructure

(3) Could lead to inflation. Low exports means low demand for pound, leading to a decline in its value on the FEX market. Fall in exchange rates means imports more expensive. High MPM so cost push inflation. H/E : current account deficit could balance itself out. Both UK and US don't have fixed exchange rate, so it could happen.

(4) countries with high trade deficits usually have high consumer spending and low savings ratio which is bad because it could suggest that they have a low rate of investment and are enjoying GDP at the expense of long term investment in economy

(5) can lead to unemployment |

|

|

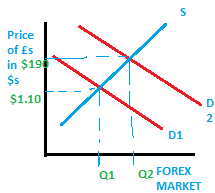

Foreign exchange diagram |

|

|

|

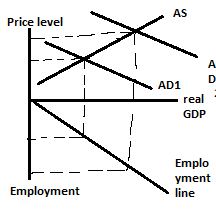

Unemployment diagram |

|

|

|

Explain how countries benefit from international trade even though they may produce similar goods and services (10 marks) |

define law of comparative advantage

(1)This means that domestic exporters will benefit from greater sales, increasing employment in these sectors. Consumers will benefit from greater choice and lower price of imports

(2) By specialising in producing a good in industry with high fixed costs i.e. car, will allow firms to benefit from economies of scale, increasing efficiency and lowering costs, lowering prices for consumers

(3) Allows firms to produce in different countries - some of which will have lower labour costs

(4) International trade opens up domestic monopolies to international competition, reducing x-inefficiency

|

|

|

Define law of comparative advantage |

There will be a gain in economic welfare if countries specialise in producing goods with a lower opportunity cost. |

|

|

Increased productivity graph |

see paper |

|

|

Discuss the factors that determine the trade competitiveness of uk economy |

(1) Exchange rate - short term competitiveness - DRAW DIAGRAM

(2) Labour costs i.e. china low wages, exports boomed

(3) Infrastructure: lowers price of exports - i.e. many trains, ships - disadvantage to landlocked places like luxembourg

(4) Non-price competition: i.e. strong branding

|

|

|

Discuss the importance of promoting free trade through organisations such as the WTO |

Free trade definition Define WTO

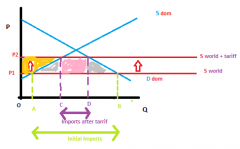

(1) draw diagram and explain. COUNTER: gov will lose some tax revenue

(2) May lead to more efficient allocation of resources - as uncompetitive firms die out but replaced with new sectors i.e. UK clothing and finance.

COUNTER: can harm develloping countries who may rely on foodstuff for exports - makes economy more vulnerable to the price fluctuations associated

(3) Firms can benefit from greater economies of scale - especially in industries with high fixed costs. Leads to lower production cost and lower price. Counter: Tariffs protect infant industries which may not survive. It is okay to remove tariff barriers at this point

(4) Tariffs can protect against dumping - when another country has a surplus and so sells very cheaply on world market, supressing prices |

|

|

Define free trade |

Free trade is when countries can trade with one another without tariffs and protectionist policies |

|

|

Free trade diagram |

|

|

|

Evaluate the potential impact on the economic growth of the UK economy if it were to adopt the single currency |

(1) Lead to greater competitiveness of UK goods in Eurozone - as lowers transaction costs. 60% of UK exports to eurozone so important. H/E: transaciton costs already low

(2) Lead to stability of exchange rates; UK exporters atm could suffer from rapid appreciation in exchange rates against euro damaging export market. Stability could increase investment H/E; exporters already insure against this

(3) Easier to compare prices throughout the Eurozone - increase competitive pressures and keep prices low

(5) Leads to surrenderring of UK interest rates control to ECB. May lead to interest rates not suitable for economy. I.e too high when UK in recession - leading to further unemployment. Also nature of UK housing market, where high interest rates will lead to lower disposable income (many people have variable mortgage)

(6) UK wouldn't be able to pursue its own monetary policy - in 2009 UK devalued its currency by 26% which led to it recovering more quickly. Eurozone has recently gone into deflation

|

|

|

Evaluate the possible impact of expansion in the EU on UK economic performance |

EU has recently expanded to Bulgaria and Romania

(1) EU has zero-tariffs policy, lowering trade bariers and acting as a signle market. Therefore, lead to UK having a greater export market increasing employment. Also, could lead to cheaper imorts as new countries likely to have lower wages.

(2) Leads to free movement of people - skills shortages - reduces dependency ration H/E leads to increased pressure on social housiing and public services

(3) Leads to free movement of capital - inflow on financial account on balance of payments, funding a current account deficit.

(4) leads to increased competitivenness amongst new members with lwoer wages - reduces x-inefficiency in Uk firms |

|

|

Explain how exchange rates are determined in a floating exchange rate system |

Floating exchange rate definition

(1) Depends on demand for exports and imports - based on inflation rate relative to elsewhere. More competitive goods, greater exports

(2) Depends on speculation - buyers buy now to try and make profit

(3) Depends on interest rates - hot money flowing in |

|

|

Floating exchange rate definition |

Exchange rates which depend on the demand and supply of a currency - not fixed |

|

|

Evaluate possible impact on UK macroeconomic performance of a sustainede rise in the value of the pound agaist the euro and US dollar |

(1) leads to lower employment

(2) leads to lower inflation - (1) lower AD (2) cheaper to buy imports (3) my encourage firms to cut costs to remain competiitive

(3) |